INTRODUCTION

Travel and tourism sector is one of the crucial concept subject to sustainable development and growth of economies. As per increasing trends of travel and tourism organisations are putting interest towards investing in tourism sector to gain profitability. How financial resources and financial information are utilised to execute the business and operations of organisation explained in this report (Spencer and Zembani, 2011). Travel and tourism sector is the only option for economical growth and development of a nation. Tourism introduce the country with global economy and provides a path to represent its culture and values at international level.

Cost volume profit concept is illustrated to assist management decisions in travel and tourism sector also define in this report. Management accounting information and decision making tools in travel and tourism sector also defined in this context. Sources of funds, and distribution of funds in respect of public and non public tourism development also defined in this context. Dalata Hotel Group and Carnival Corporation plc are chosen organisation to elaborate the concept of travel and tourism sector defined in this report.

TASK 1

1.1 The importance of cost and volume in financial management of travel and tourism sector

Cost

Cost is the essential element which comes under business context. Cost contains the over all consideration which is paid by the organisation to assist the functions and operations of organisation. Associations has to pay an amount to execute the functions of business which is considered as a cost. This plays vital role in terms of attaining the desired aim and objective of organisation. There are type of costs found in organisational context which remain associated with different functions and operations.

Carnival Corporation plc is world's largest leisure travel organisation with a portfolio of cruise brand in North America, Europe. As the organisation provides travel services and products to clients. The cost concept is mainly defined below:

Direct cost: It is a cost which is directly incurred in the operations and function organisation. The cost and price mainly associated with production and services which are produced in terms of profitability and analysis. Direct cost affect the cost and increase the price of products and services (Tribe, 2015).

Indirect cost: this is the cost which not remain associated directly with operations and functions of organisation. This cost remain ineffective in decision making. There are type of indirect cost remain associated with operations and management as administrative cost, office expenses, fixed charges are the indirect cost. As the cost as staffing arrangement, washing and cleaning of cruise rooms are some indirect cost found in Carnival Corporation and plc.

Fixed cost: this cost doest not vary as per the variations in production units of organisation. There are type of strategies and plans made subject to control fixed cost. This cost has to pay by the organisation even after having nil production. Cost of maintenance, fuel, electricity, taxes and rates are some fixed charges which are paid by Carnival Corporation plc.

Allocation and apportionment: allocation and appropriation indicates towards arrangement of financial resources and allocation of financial resources defined in this context. Cost volume and profit ratio mainly associated with making the plans and strategies for better appropriation and management of resources.

Volume

Break even analysis: this analysis mainly done to elaborate the concept of break even sales in terms of maintain the optimum level of production units to earn desired profitability. For management decision this plays vital role. There are type of strategies and plans defined subject to operate the profitability and consistency (Vanhove, 2011).

As Carnival Corporation and Plc follow the break Even analysis concept in terms of managing the services and products in more effective and consequent manner. Tour packages prices, plans, rental services of cruises are the main concept considered while evaluating the desired price and cost of plans.

Profit

Gaining profitability is one of the main objective of organisations. There are type of strategies and plans made to enhance profitability and reduce cost is the main aspect in organisational context. Carnival Corporation plc is concerned with its profitability strategies and plans. As per analysis of volume of CCP 4986132 was recorded for the year 2016 and the price was calculated as $57.31 and grow by 0.15%.

1.2 Pricing methods used in travel and tourism sector

There are type of factors and elements remain associated with profitability of organisation. As estimating is an imperative in each business along these lines, travel and tourism industry (von der Weppen and Cochrane, 2012). isn't immaculate with that, it is a standout amongst the most goliath ventures, which is developing quickly and never gone in make back the initial investment point. It has been verify that there are different kinds of estimating procedures considered in an association to set costs of the items and administrations which are putting forth by them, Cost in addition to is one of the viable targets to accomplish future points and objectives. this is one of the best wellspring of salary for any person who is seeking after in movement and tourism association and for administration of the nation additionally, to produce greatest income to help economy. through utilizing diverse sort of costing by including all out acquiring of an association in view of genuine cost of administrations.

Carnival Corporation and plc additionally considering different parts of evaluating strategies to choose the cost of their offering solaces, they are putting forth a few plans like rebates on some particular administrations and additionally rivalry valuing. The firm should be investigate these sorts of costs before select one, as organization can offer markdown cost in off season for instance, this is journey relaxation travel firm. So it can build the season of pinnacle season to pick up the benefit, on the grounds that around then the voyagers won't worry about costs, and in off season rebate is best strategy to support and keep up the tasks.

1.3 Factors affecting profit for travel and tourism sector

There are different area which impacts wage of movement and tourism, that are as per the following-

Occasions: Events are holding a noteworthy place to pull in visitors, as there are a few occasions are sorted out by the business to get the consideration (Pike, 2012). There are type of occasions and events were counted as There is any sort of celebration blossoms are going to sprout, around then a few occasions are composed by some may travel and tourism organization, for instance in Easter and Christmas duration, there are numerous occasions and gatherings are occurring and that time costs are offers with a markdown, which welcomes visitors on reasonable costs.

Seasons: There are distinctive seasons that causes the benefit of the movement a tourism industry, that seasons are known as pinnacle seasons and direct seasons. Fair Corporation and plc, brings out the clients with a view to expand gainfulness.

Currency rates: Every nation has distinctive cash rates, these contrasts from the benefits as per the organizations, Carnival Corporation and plc has clients from over the outskirts and that effect on its business because of separation of cash rates (Ritchie, Maya Molinar and Frechtling, 2011).

Normal calamity: The cataclysmic events are a major annihilation for the traveller since Tourist maintains a strategic distance from to go on certain area which have in threat state.

Psychological oppression: Terrorist assaults a standout amongst the most pivotal factor that consequences for the benefits. There are such a large number of nations which get in the downsides as a result of terrorism and furthermore lose the odds to over come this dread in individuals' brain.

Travel patterns: Patterns can offer the intriguing goals, similar to shorelines, European visits, etc. Patterns have a specific specialities, to make each year another prominence among guests. Travel is like another movement, and patterns creates from multi year to one year from now to figure out what a sort of things can be improve the situation showcasing.

TASK 2

2.1 Different types of management accounting information used in travel and tourism business

Accounting for management and operations are counted as management accounting. it is an arrangement identified with the budgetary information and furthermore give a counsel to an association for the improvement and development of business. Management and alludes to the everyday schedule exchanges which are expected to endeavour through directors. It causes an administrator to gather and furthermore control the information and furthermore data keeping in mind the end goal to determine any issue in a successful way. It is vital that it can build up an effect on business of an association. There are distinctive sorts of administration bookkeeping identified with the movement part given beneath as above:

Variance analysis: It is a sort of administration bookkeeping data utilized through the organization. In the event that the execution of an association is great at that point there is no issue. In the event that if a fluctuation is awful then in setting to this it is fundamental for administration to take some remedial activities thus the execution of an association can be better. In this instrument a difference is computed partnered to the work and material. With the assistance of change an association can decide the awful and great execution level of an association (Evans, Stonehouse and Campbell, 2012).

Job cost report: In this there is no compelling reason to give extra projects and time to squander. In this, a whole region of Dalata Hotel Group plc association where the administration of this organization attempt to expand its benefit level on the particular occupation with the assistance of utilizing numerous administration devices and systems.

Investment decisions: There is a ned of each business to direct their business in a legitimate way and furthermore recognizing the numerous venture alternative with a specific end goal to pick up benefit. These are the choices which are identified with utilization of capital assets in a powerful or legitimate way keeping in mind the end goal to increase some great return in an appropriate way.

Financial projections: This sort of oversee bookkeeping is essential for an association in setting to get some surprising expense and furthermore income in future. It is worried about the evaluation and furthermore investigation of future related costs to business. The future choices of an association can be gives with the assets of money related assets.

Cost allocation report: it is essential that chief ought to keep up the records of all business exercises identified with the result. In this give report, it is important to give a distribution to each asset which are available in an association at the beginning time so that in future no equivocal sort of circumstance are emerge.

Budget report: Budgetary reports shows the desires for top administration from the low and centre administration. The over all costs which can be happened later on and after that likewise archived in the report of spending plan. With the assistance of utilizing this, the entire costs can be happened later on that can be accounted for and it will be useful in building up a viable arrangement. Under this two distinctive segment are incorporated one is worried about the income and other is taken a toll. It is a best method for to perform numerous bookkeeping related exercises. Financial plan is a sort of articulation which is utilized by refereed to business firm in setting to extend and the normal consumption and wage. The administration of this refers to set up a compelling spending plan to accomplish the set focus in given time frame.

2.2 Use of management accounting information as a decision making

Dalata Hotel Group plc utilizes a portion of the viable devices for gaining the more benefit in an association. The proprietors of an association devour its assets in various capital tasks and the principle thought process of administrators to need to great return of speculation. A portion of the venture evaluation instruments are given beneath as above:

Payback period: The Dalata Hotel Group plc firm embrace and work on those items which can give the more benefit and return in a legitimate way. It is mostly executed through private company firms for controlling the income rather than any arrival. It decides a period in which firm can accomplish the ideal rate of come back from contributed venture (Gibson, Kaplanidou and Kang, 2012).

Discounted cash flow: Dalata Hotel Group plc firm put cash in those activities which give the more benefit and rate of come back to lodging. Under this the greatest rate of return can be accomplished in future in this present given situation.

Accounting rate of return: Sit is a powerful and better approach in performing numerous exercises and assignments appropriately. It characterizes contrast among the business venture costs which firm put resources into request to gain more benefit.

There are a few employments of administration bookkeeping data as an instrument of basic leadership given below:

Keeping expenses in control: In setting to recognize the measure of all costs supervisor required to build up a forecast. With the assistance of influencing the best possible spending plan to firm can oversee and control all financial plan. Essentially, the business related choices are made by the anticipated sum. On the off chance that this foresee sum will not be right then the spending will naturally off-base. It is fundamental that the measure of predication ought to be characteristic. So in setting to building up a financial plan, it is basic for boss to take after mindful approach.

Deciding poor performance: With the help of utilizing the bookkeeping data manager can decide its territories of awful execution. It must be finished utilizing the fluctuation investigation. In the event that chiefs will be fruitful in recognizing the poor zones then it will be useful in building up a successful business methodology which will be useful in guaranteeing about this sort of fluctuation. It will be useful in enhancing the execution level of refereed to business firm.

Assistive in taking price minimization decisions: The make back the initial investment investigation helps in demonstrating the base level of offers which firm require to be deal in setting to take care of the assembling expense. Through building up the utilization of make back the initial investment examination the choices identified with the cost can be taken through administrators. With the assistance of this organization can lessen the its assembling cost and from this it can give the great nature of items to stonecutters at sensible cost. Through this the deals will be expanded and the benefit level of firm will likewise be improved.

TASK 3

3.1 Interpretation of financial accounts of travel and tourism company

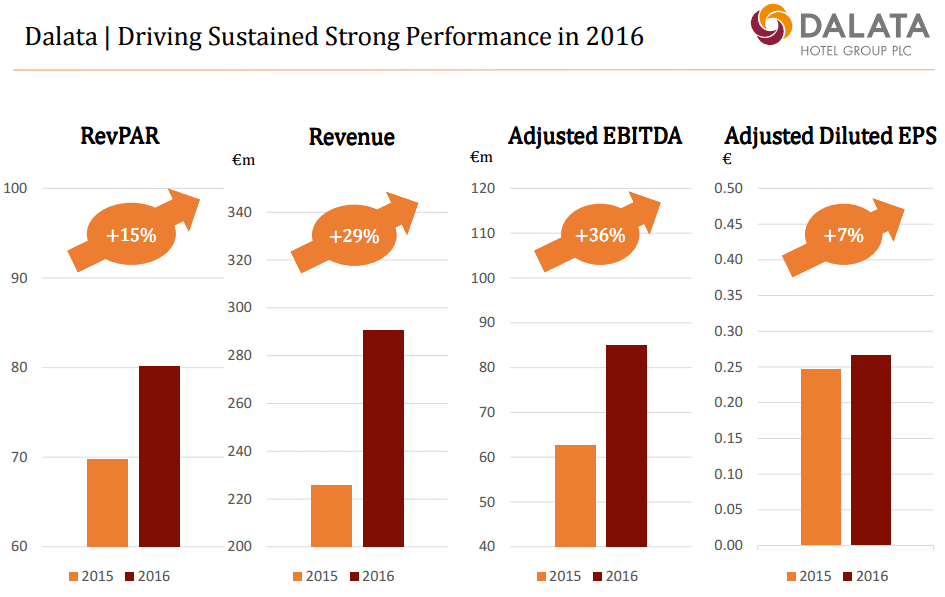

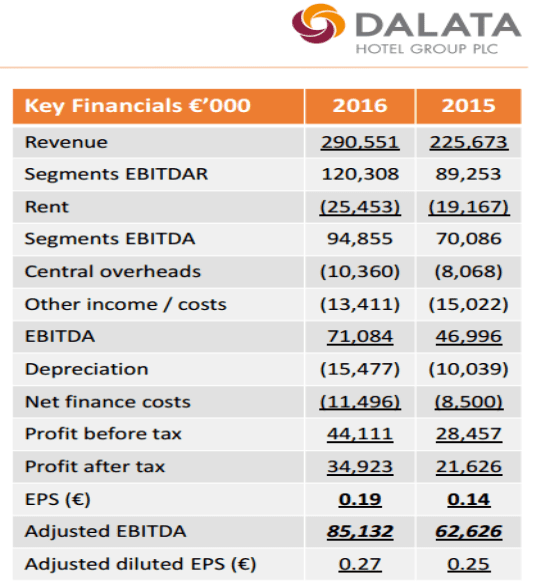

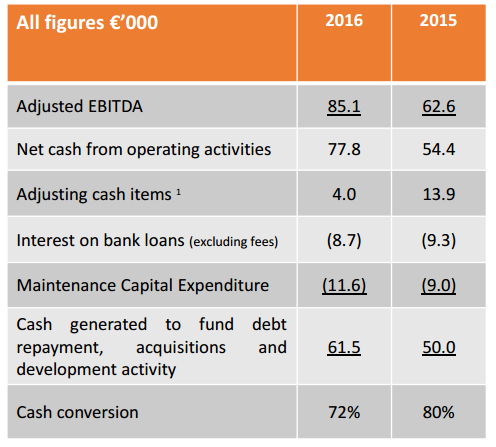

Dalata's financial performance and measurement:

Cash flow statement: It appears to understood monetary records get ready by an association. This will give precise detail of trade stream cause out the organizations. Alongside this, it give compelling information pretty much the capital venture exercises, for example, deals buyer of settled assets. It is obviously express that variety in real money inflow and outpourings are gathered from organizations last explanations. It is said under segment 7 (IAS7) that gives legitimate arrangement for working trade out an association. This is by all accounts a successful angle which is connected with add up to working benefit an organization in the wake of getting investigation of aggregate capital utilized amid the time. It is a gainfulness proportion which show how effective Dalata Hotels group is.

Income statements: an income statement provides an brief information regarding the profit and loss earned by the organisation during the year. As per above analysis of financial accounts of Datala group the net profit before tax was calculated as 44111 and after deduction of tax the net profit was earned by the organisation was 34923 which was increased by 13297 for the last year 2015 (Wong, Mistilis and Dwyer, 2011).

Current ratio: this ratio mainly defines the liquidity position of organisation. As per above financial reports the current ratio is calculated around 1.44 for Dalata hotel group. As per above financial statements of Dalata Hotel Group the total current assets were recorded as 98711 for the year 2016 and total current liabilities was recorded as 68821. this is calculated by proportion of current assets to current liabilities. It is summarised that the major portion is calculated as 2.89 times in terms of total assets and counted with total debts in accounting tear 2015.

Acid test ratio: this ratio mainly clarify the relations between its current liabilities and the liquid assets (Heung, Kucukusta and Song, 2011). Liquid assets are the assets which are used to execute day to day transactions. As per the calculation 1.40 was calculated in the form of acid test ratio. Liquidity of Dalata Hotel group decreased in terms of last year as per last year's acid ratio was counted as 2.86 in 2015.

Acid test ratio

|

2015 |

2016 |

|

2.86 |

1.41 |

Return on net asset: this ratio tells the conditions of defining the return on assets comparison to turn over of organisation. As per analysis of return on net assets ratio was calculated as 3.78 in 2016 which was measured decreased by 4% form last year. There are favourable outcomes comes form the analysis of return on assets. By using the fixed asset the working capital to great outcomes.

Return on net assets

|

2015 |

2016 |

|

3.74 |

3.78 |

Return on capital employed- it is one of the key financial aspect which is considered essential subject to measure a company's profitability and the efficiency with the capital ratio and present the capital stability (Ma and Hassink, 2014).

Return on capital employed

|

2015 |

2016 |

|

5.82 |

4.98 |

Stock turnover ratio

|

2015 |

2016 |

|

89.50 |

69.40 |

Stock turnover ratio: From the above proportions, it has been seen that stock turnover proportion of the organization is demonstrating greatest rate in a year ago with aggregate of 89.50 time. It get diminish to 69.40 times in display time.

Net profit ratio

|

2015 |

2016 |

|

9.58 |

12.02 |

Net profit ratio: As per the above net productivity is more compelling in contrast with a year ago. This mean the benefit gain amid the time is sufficiently adequate as per the most recent year.

CONCLUSION

As per above discussed report it is concluded that finance and funding has become crucial subject in terms of boosting the economic structure of country. the concept of finance and funding in travel and tourism sector defined in organisational context in above defined report. Essentialness of cost volume and profit for effective management decisions are defined in this context. Use of management accounting information as a decision making tool in travel and tourism business also illustrated in this context. Financial interpretation of financial information and data are also done in this report. Apart form it source and distribution of funding for public and non public tourism development also defined in this context.

Visit the sample section of our website and enjoy more such informative write-ups written by our homework help professionals.

REFERENCES

Books and Journals:

- Spencer, J. P. and Zembani, P., 2011. An analysis of a national strategic framework to promote tourism, leisure, sport and recreation in South Africa: tourism, leisure, sport and recreation. African Journal for Physical Health Education, Recreation and Dance. 17(2). pp.201-218.

- Tribe, J., 2015. The economics of recreation, leisure and tourism. Routledge.

- Vanhove, N., 2011. The economics of tourism destinations. Routledge.

- von der Weppen, J. and Cochrane, J., 2012. Social enterprises in tourism: An exploratory study of operational models and success factors. Journal of Sustainable Tourism. 20(3). pp.497-511.

- Pike, S., 2012. Destination marketing. Routledge.

- Ritchie, J. B., Amaya Molinar, C. M. and Frechtling, D. C., 2011. Impacts of the world recession and economic crisis on tourism: North America. Journal of Travel Research.49(1). pp.5-15.

- Evans, N., Stonehouse, G. and Campbell, D., 2012. Strategic management for travel and tourism. Taylor Francis.

- Gibson, H. J., Kaplanidou, K. and Kang, S. J., 2012. Small-scale event sport tourism: A case study in sustainable tourism. Sport management review.15(2). pp.160-170.

- Wong, E.P., Mistilis, N. and Dwyer, L., 2011. A framework for analyzing intergovernmental collaboration–the case of ASEAN tourism. Tourism Management. 32(2). pp.367-376.

- Heung, V. C., Kucukusta, D. and Song, H., 2011. Medical tourism development in Hong Kong: An assessment of the barriers. Tourism Management.32(5). pp.995-1005.

- John, S. and Susan, H., 2015. Business travel and tourism.

- Koutra, C. and Edwards, J., 2012. Capacity building through socially responsible tourism development: A Ghanaian case study. Journal of travel research. 51(6). pp.779-792.

- Ma, M. and Hassink, R., 2014. Path dependence and tourism area development: the case of Guilin, China. Tourism Geographies. 16(4). pp.580-597.