INTRODUCTION

In present era, organizations operate in the competitive environment due to which it has become difficult for firms to sustain in the market for longer period of time and is leading to decline in their overall efficiency level. Further, various decisions have to be taken by the management which are linked with the overall development and growth of company in market (Leach, 2011). Decisions have to be taken by top authorities of firm at strategic, tactical and operational level. Moreover, without analysing the market conditions, it is not possible for enterprise to take appropriate decisions and in turn, it acts as the hurdle in accomplishment of desired goals and objectives. For carrying out the present study, organization chosen is WM Morrison which operates in retail sector and is well known in the market for range of products which it offers to its target market. The basic aim of present research is to understand the consumer behaviour and attitude of people in relation with food discount survey and through this, business enterprise can take effective decisions. Various tasks have been covered in the study which involves plan for the collection of primary and secondary data, survey methodology etc.

TASK 1

1.1 Plan for collection of primary and secondary information

In order to obtain effective decisions, it is necessary to collect the information from both primary and secondary sources so that organization can easily enhance its performance in the market. Main mission of organization is to make it “Different and better than ever”. Main stress of management is on enhancing the efficiency, capturing the growth and driving the top line. Therefore, by considering both primary and secondary data, it is possible for firm to know the perception of consumers about food discount retailing (Smit and Trigeorgis, 2011).

Plan for collection of primary information

For collection of primary information, technique of online survey has been considered and well structured questionnaire has been designed with the help of which attitude and overall preferences of customers can be known in Greater London regarding food discount retailing. Due to this basic reason, collection of primary information is considered to be more effective and in turn, leads to the accomplishment of desired goals and objectives (Jankowicz, 2004).

Plan for collection of secondary data

For acquiring secondary information, various books, journals and online articles have been referred. Further, specific information has been taken from annual report of WM Morrison with the help of which effective decisions can be taken easily.

1.2 Survey methodology and sampling frame used

Survey methodology

For conducting survey in an effective manner, customers of WM Morrison have been selected who are living in Greater London. Main aim behind carrying out survey is to determine the behaviour of consumers and preferences towards food retailing by WM Morrison (Day, 2005). Further, for conducting online survey, email id of customers has been obtained who are living in Greater London. So, with the help of this survey methodology, it is possible to obtain effective primary information and it can support in accomplishing the aim of research as well.

Sampling frame

Sampling frame is associated with the selection of sample size from which data has to be collected (Greasley, 2004). For acquiring information, technique of simple random has been adopted where every individual is having equal chance of being selected for providing the information regarding food retailing. Sample size of 40 customers has been selected who are above the age group of 18 and are regarded as adult. Therefore, by considering customers of WM Morrison as the sample, it is possible to collect accurate and up to date information and effective business decisions can be taken easily.

1.3 Questionnaire for the survey

|

Name Age

Gender

Working status

Do you prefer to buy products from discount retailing shops by WM Morrison?

How much distance you have to travel daily for purchasing products from discount stores?

What are the factors that attract you towards product range of discount retailing?

How frequently do you purchase food products from discount food retailers?

How much amount do you spent on commodities offered by food discount retailers on single purchase?

In your view, which firm has the best discounted food retailer in UK?

From which source do you receive information regarding products and services of discounted food retailer of WM Morrison?

Does any type of improvement is required in the discounted products of WM Morrison?

|

Report

For collection of primary along with secondary data appropriate tools have been adopted. Primary information has been obtained from the well designed questionnaire and main stress is on knowing the preference along with attitude of target market regarding food discount retailing. Through this information it is possible to accomplish overall aim of the study. Further, secondary information has been collected with the help of books, journals and online articles which is also effective for the research. Survey methodology has been employed where survey has been carried out in the market of Greater London. Sample size of 40 customers has been selected who are above the age group of 18 and are regarded as adult. By selecting customers of MW Morrison it is possible to know overall perception of customers regarding food discount retailing. Further, each and every question in the questionnaire focuses on the aim of the study and respondents have been asked different questions so as to know whether customers prefer to purchase products from food discount retailing stores or not.

Also read the free sample on leadership and teamwork in the public services.

TASK 2

2.1 Information for decision making by summarizing information

|

Year |

Sales |

Profit |

|

2009 |

14,528 |

460 |

|

2010 |

15,410 |

598 |

|

2011 |

16,479 |

632 |

|

2012 |

17,663 |

690 |

|

2013 |

18,116 |

636.54 |

|

Descriptive statists for WM Morrison |

|

|

Sales £m |

|

|

Mean |

16439.2 |

|

Standard Error |

671.672 |

|

Median |

16479 |

|

Mode |

#N/A |

|

Standard Deviation |

1501.9 |

|

Sample Variance |

2255717 |

|

Kurtosis |

-1.9536 |

|

Skewness |

-0.1874 |

|

Range |

3588 |

|

Minimum |

14528 |

|

Maximum |

18116 |

|

Sum |

82196 |

|

Count |

5 |

2.2 Analyze results to draw valid conclusions

After analysing the information, it has been found that sales revenue of WM Morrison is increasing rapidly and this is showing efficiency of firm in carrying out its operations. As compared with the past, performance of company has improved and it is supporting the firm to face challenges which are present in the business environment (Banerjee, 2008). Further, on the basis of sales figure, mean, mode and median has been calculated. Mean for the five year sales revenue of entity is 16439.2 and it is representing the minimum average sales of WM Morrison. Apart from this, median of data is 16479 which show sales value in the middle year. Moreover, no sales figure is repeating due to which it is not possible to determine the mode.

2.3 Analyzing data using measures of dispersion

Measure of dispersion supports in knowing the variability in numbers and in overall rate by which elements can be spread out. Different techniques are present on the basis of which measure of dispersion of sales revenue of firm can be determined easily. Further, standard deviation is considered as one of the most significant measures of dispersion and assists in knowing the variation in sales revenue of WM Morrison (Day, 2005). On the basis of calculation, it has been assessed that standard deviation for sales revenue is 1501.9 which is regarded as high and is showing that sales revenue of company can vary from mean. On the other hand, through standard deviation, it is possible to identify the risk associated with company on the basis of which effective actions can be taken for managing the risk and it focuses on long term sustainability of business enterprise. Therefore, through this, it can be said that overall value of standard deviation represents high growth in sales of WM Morrison and shows efficiency of company in carrying out its major operations.

2.4 Explain how quartile, percentile and correlation coefficient are used to draw valid conclusion

Quartile refers to segregation of data into groups where each group undertakes equal number of values (Arnicans, 2012). Further, percentile divides large set of information into 100 equal parts. With the help of percentile and quartile effective decisions can be taken easily for welfare of business enterprise. Moreover, it becomes easy for organization to accomplish its desired goals and objectives in appropriate manner.

|

Quartile 1 |

15410 |

|

Quartile 2 |

16479 |

|

Quartile 3 |

17663 |

|

25th Percentile |

15410 |

|

50th Percentile |

16479 |

|

75th Percentile |

17663 |

Calculation of quartile assists in determining the variability in the sales revenue of the company in each quarter. On the basis of above calculation it has been identified that value of sales revenue of WM Morrison is increasing in every quarter. Further, on the basis of information it is possible to forecast sales revenue of company for future and in turn effective decisions can be taken in relation with investment projects which is beneficial for company like WM Morrison (Carmichael, 2011). Whereas, it also assists in taking decisions regarding functional operations of company.

On the other hand by calculation percentile it has been identified that in the last five years, 25% of the sales revenue of the company were below or equal to 15410. Further, 50% of the sales revenue lie below or equal to 16479 and 75% of the sale were below or equal to 17663. So, it is representing that firm is expanding year after year and profit margin is enhancing. Percentile also assists in taking different type of strategic as well as management decisions of firm (Cumulative Frequency, Quartiles and Percentiles, 2014).

Correlation coefficient

Correlation of coefficient assists in knowing the relationship between two or more variables in a given set of information (Van, Kurth-Nelson and Redish, 2012). In order to calculate correlation of coefficient researcher has acquired secondary information such as profitability of WM Morrison and it has been determined for the sales and profitability information of the organization.

|

Year |

Sales |

Profit |

|

2009 |

14,528 |

460 |

|

2010 |

15,410 |

598 |

|

2011 |

16,479 |

632 |

|

2012 |

17,663 |

690 |

|

2013 |

18,116 |

636.54 |

|

Correlation Coefficient |

||

|

Sales |

Profit |

|

|

Sales |

1 |

|

|

Profit |

0.85003 |

1 |

Coefficient of correlation lies between -1 to +1 in which value lying under -1 to 0 highlights weak relationship among variables, 0 to -0.6 shows medium association and 0.6 to -1 represents strong relationship between the variables. On the basis of above measurement it has been identified that coefficient of correlation between sales and profit of company is 0.85003. It is showing positive value between the two variables being chosen (Little, 2010). Moreover, in case if one variable changes then it can have direct impact on another also. Therefore, WM Morrison must consider both sales and profitability while taking financial decisions.

TASK 3

3.1 Appropriate information processing tools

Information processing tools supports business enterprise in taking effective decisions. Information is required at every level such as strategic, tactical and operational level. It allows business enterprise to better perform in the competitive market. Software such as Microsoft project, inventory software and software of financial analysis. Through all these information processing tools it is possible to take effective financial decisions and supports in enhancing performance in the competitive market (Nicholson and Aman, 2012). Moreover, other financial decisions have to be taken by company which considers formulation of budget, investment decisions etc. Different operational tools are present such as inventory management software and MS project through which major operations can be managed properly such as stock etc. With the help of MS project it is possible to identify critical path and assist in determining the time required for completion of project. Therefore, in this way all these information processing tools provides support in taking effective decisions and increases business efficiency.

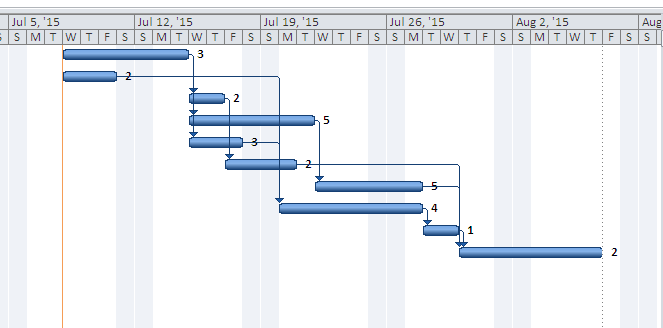

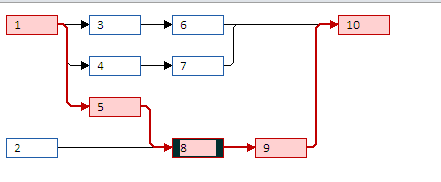

3.2 Plan for the activity and determination of the critical path for Wm Morrison plc

Critical path is regarded as the longest path and assist in knowing time required for completing project. WM Morrison project plan with all the tasks has been shown below:

|

Sr. No. |

Activity |

Task Name |

Duration |

Predecessors |

Resources |

|

1 |

A |

Preliminary design |

5 days |

3 |

|

|

2 |

B |

Market research |

3 days |

2 |

|

|

3 |

C |

Obtain engineering quotes |

2 days |

1 |

2 |

|

4 |

D |

Construct prototype |

5 days |

1 |

5 |

|

5 |

E |

Prepare marketing material |

3 days |

1 |

3 |

|

6 |

F |

Costing |

2 days |

3 |

2 |

|

7 |

G |

Product testing |

4 days |

4 |

5 |

|

8 |

H |

Pilot survey |

6 days |

2,5 |

4 |

|

9 |

I |

Pricing estimates |

2 days |

8 |

1 |

|

10 |

J |

Final report |

6 days |

6,7,9 |

2 |

Critical path

Critical path for new product is A-E-H-I-J = 5 + 3 + 6 + 2 + 6 = 22 Days. All the tasks in critical path are highlighted in red and in this time period entire project can be completed.

3.3 Use of financial tools for decision making

Various financial tools are present through which it becomes easy for business enterprise to know in which project funds to be allocated and in turn leads to efficient utilization of financial resources of the company. Any project is evaluated on the basis of return and profits that can be earned by investing into it. Such tools consider discounted and non discounted investment techniques (Prieto and Revilla, 2006). Non discounted techniques include different method which considers time value of money. Net present value and IRR are the two most commonly used methods on the basis of which investment decision can be taken easily (Kumar, 2010).

|

Net Present Value |

||||||

|

Project A |

Project B |

|||||

|

Years |

Net cash flow (£000) |

Present value of 10 % |

Discounted Net cash flow @10% (£000) |

Net cash flow (£000) |

Present value of 10 % |

Discounted Net cash flow @10% (£000) |

|

1 |

100 |

0.909 |

90.9 |

50 |

0.909 |

45.45 |

|

2 |

200 |

0.826 |

165.2 |

150 |

0.826 |

123.9 |

|

3 |

400 |

0.751 |

300.4 |

300 |

0.751 |

225.3 |

|

4 |

300 |

0.683 |

204.9 |

400 |

0.683 |

273.2 |

|

5 |

200 |

0.62 |

124 |

300 |

0.62 |

186 |

|

Total Discounted Cash inflow |

885.4 |

853.85 |

||||

|

Less: Initial Investments |

500 |

500 |

||||

|

Net Present value |

385.4 |

353.85 |

||||

Internal Rate of Return:

|

IRR |

Project A |

|

Years |

Cash flows |

|

Initial investment |

-500 |

|

1 |

100 |

|

2 |

200 |

|

3 |

400 |

|

4 |

300 |

|

5 |

200 |

|

IRR |

33.21% |

|

IRR |

Project B |

|

Years |

Cash flows |

|

Initial investment |

-500 |

|

1 |

50 |

|

2 |

150 |

|

3 |

300 |

|

4 |

400 |

|

5 |

300 |

|

IRR |

28.77% |

After calculating NPV and IRR it has been found that project A is more feasible for business enterprise as its present value is more as compared with project B. Further, internal rate of return for project A is 33.21% which is showing large amount of profits can be earned by allocating funds in the proposal (Schraeder and Morrison, 2005). Therefore, through this it can be said that the two techniques chosen for selection of project are appropriate and has assisted in selection of project which is the major issue of management.

CONCLUSION

From the entire study it has been found that overall performance of WM Morrison in the market is effective but the major challenge of competition is adversely affecting firm. Further, organization is effective enough to satisfy need of its target market and it is the major reason behind success of company in the market. Moreover, on the basis of investment appraisal technique it has been found that project A is more feasible for company as it yield higher return and present value. On the other hand, market research has shown customers prefer to purchase products from discount retailing and they are satisfied with services of company.

We have more such write-ups in the sample section of our website for students who raise do my assignment queries in order to achieve top academic grades in their academic documents.

REFERENCES

- Arnicans, F. 2012. Information Processing Technqiues and Environments.Raina Blvd: University of Latvia.

- Banerjee, G., 2008. Cost Accounting: Theory and Practice. PHI Learning Pvt. Ltd.

- Day, A., 2005. Mastering Financial Mathematics with Excel: A Practical Guide for Business Calculations.Financial Times/Prentice Hall.

- Greasley, C., 2004. Operations Management.SAGE.

- Jankowicz, C. B., 2004. Business Research Projects.Cengage Learning EMEA.

- Kerzner, P., 2012. Project management: a systems approach to planning, scheduling, and controlling. John Wiley & Sons.

- Leach, L. 2011. Critical chain project management. Artech House.

- Smit, H. S. and Trigeorgis, Q., 2011. Strategic investment: Real options and games. Princeton University Press.