INTRODUCTION

Planning and growth is the strategic business activity that enables business owners to plan and track organic growth in their revenue. This helps business to adopt the effective planning growth to their limited resources toward a centred effort to better adopted model in order to sustain in the industry in long term. Planning and growth is the required tool for the development of business activity. Present study will be based on Planning and growth of the business. For that, Oak Cash & Carry company will be taken into action. It is the grocery Wholesaler in Banbury. Under which various options for growth by utilizing different analytical framework for gaining competitive advantage for the company. Besides, study will also evaluate the risk factors that are associated with the growth factors. Besides, assess the potential sources for raising finance to fund your preferred option for growth.

LO1

Discussing the various options' growth by utilizing different analytical framework for gaining competitive advantage.

Growth strategy is the most essential task for the business growth. Overall, it brings new better objective and task oriented performance. On the other side, growth refers to different forms of business ideas that can help to recover the new opportunity and growth. It helps business to take at good level and brings new opportunity and growth (Armstrong and et.al., 2015). Overall, Oak Cash & Carry needs to take the better opportunity by adopting change environment that helps to sustain the business growth and sustainability level in the competitive market. In spite of that, Goodwill and reputation also helps to win confidence of the society. It helps to enable the effective marketing performance growth in good effective manner. This is the reason when large number of new investors, customers and employees. There are discussing some following kinds of elements that helps to evaluate business growth.

Competitive Advantage:

It is the factor that helps company to produce goods and services of equal value at a lower price or in a more desirable fashion. This must be the favourable position of the organizations (Choi, Kim and Chung, 2017). To gain and maintain a competitive advantage. This makes the better advancing and effective nature of growth in order to meet the needs of the organizations. On the other side, cost and differentiation advantages are known as positional advantage. Along with that, it will also cover the better objective. Overall, it brings new effective services and better task oriented process in order to meet the needs of the organization goals. Overall, it brings new better environmental growth in order to meet the best approachable task oriented goals. Overall, it brings new better services and long lasting performance.

Resources: It is the another core competent factor of competitive advantage for growth which is benefited for the company growth in order to meet the needs of the organizations. Resources is the broad concept that classified on the basis of upon their availability. These are of two types renewable and non renewable resources.

Capabilities: it is the another sourcing and better improvement and best effective growth and task oriented performance (Deng, Ma and Zhang, 2017). It is the another core competent component of competitive advantage of the company and makes better services and growth.

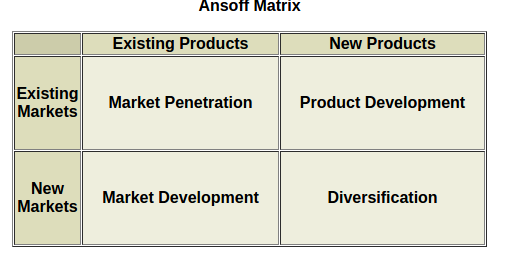

Ansoff Matrix

Porter's five forces strategies is very helpful to determines whether a firm's profitability is above or below the industry average. It is the another major goal oriented task that helps to make the better effective growth making performance level. The choice this makes the proper impact full decision making approach. That helps company to make the proper changes and impact full excision making approach (Ansoff Matrix, 2018).

Illustration 1: Source of competitive advantage

Source: Ansoff Matrix, 2018

This makes the proper changes and impact full decision making approach. This strategy is the growth oriented process that helps to take better growth for Oak Cash & Carry. Generic strategies applied on the product or services in all industries and all types of organizations. There are includes some following strategies

Market Penetration: it is the first component of Ansoff matrix model that seek to achieve growth with existing products in their current market segments, aiming to increase its market share. This helps Oak Cash & Carry to take new product strategies in their wholesale business.

Market development : This model or strategy of Ansoff's model will generate growth for targeting its existing product development into new segments. This makes the proper implementation process and helps to generate new planning and growth for the company benefits (Floyd, 2015). This is the another effective growth and task oriented process or making good things.

Product development: Product development strategy is the better effective strategy for the company planning and growth. Diversification is the most risky and challenging growth channel that makes the process more reliable and challenging. Overall, things has to be change according to needs and growth. With the help of product development, company can easily get the better profit margins and satisfaction level from the customers.

Diversification : it is the another model or strategy of planning of growth strategy that helps to collect the better advancing growth and better effective services. This strategy defines the importance of new changes that is most required for the organization development. This makes the proper effective challenging and growth. Overall, it brings new better effective growth channel in order to meet the needs of the new organization development (Gurran and Bramley, 2017). This model applies when company introduce new product and services. Such as Oak Cash & Carry adopts the new product line into its business activities. Overall, it makes the proper implementation and fast growing performance level. Overall, it brings new major changes and better effective growth.

On the basis of above, discussion market penetration is the least risky strategy that helps business to form a business growth and impact full that helps to make the proper changes and impact full decision making approach. Besides, it also helps to bring the new better growth and challenging behavior (Han and Lin, 2017).

LO2

Sources of funding to business

There are various ways through which Oak cash and carry company can access funding. Mostly, this is categorized into two parts i.e. debt and equity. Both these ways have different sources and the explanation of these sources is as follows:

- Personal saving: This is one of the best sources to raise funding because owner utilises his own money to start business.

- Family and friends: An Oak cash and carry company's owner can request their friends and family members to assist their business. They can provide debt and equity funding. It is the best source but if business fails then it will destroy the relationship, hurt feelings and ruin friendship. Before taking funds from family and friends, be ensure that they know about the true risk factors(Pothukuchi, 2015).

- Cloud funding: By this factor, it allows small amount of capital from numerous group. These groups allow the business to pitch their innovative ideas to investors via social media as internet. If business gets success then it will attract more investors to contribute funds in their business.

- Angel investors: These are the members who provide funding in exchange of shares of business. Investors are funding in the business to spread risk and pool research. They can offer advice and valuable suggestions to business since they have knowledge and experience of the market and industry(Boddy and Hickman, 2014).

- Venture capital: These are investors who put funding in exchange of equity shares. They invest in the business to get better returns on their investment. These ventures not only provide funding but also offer mentorship to develop the business. Venture capital gives instant credibility to expand the business for wide networks.

- Bank loans: These are the popular sources of funding. But bank requires a track record of Oak cash and carry company before providing loan and also secured assets. Bank gives various funding as per the requirements and this also furnishes a quick and instant funding(Lê And et.al., 2017).

Benefits and drawbacks of each source

|

Benefits |

Drawbacks |

|

|

Personal saving |

|

|

|

Family and friends |

|

|

|

Cloud funding |

|

|

|

Angel investors |

|

|

|

Venture capital |

|

|

|

Bank loans |

|

|

Apart from this, there are some other advantages and disadvantages of debt and equity such as it is a permanent source of finance, no obligatory, controlled financial leverage ratio, retained earnings and right shares. Disadvantages are like higher flotation cost, high cost of funds, no tax shield, dilution of control, underwriting of shares and no benefits of leverage.

Methods to access funds

As there are various sources by which Oak cash and carry company can funding their business, so there are different methods as well to access these sources such as government grant, crowdfunding and upraised from investors. Government agencies provide funds to the project which will be beneficial for the society and public. Before funded the projects, government appoints two external peers such as reviewers and internal research committee who reviews all the applications(Han and Lin, 2017). After reviewing all the applications, short-listing and ranking is made or government funded the projects of Oak cash and carry company. In addition to this, Oak cash and carry company has to present the history and project to raise capital from investors. They have to display it into magazines or other internet websites with high potentiality of the projects and high rate of return on the plan. Oak cash and carry company should show the content more attractive to catch attention of investors towards their project. Business should give rewards and other offers to investors after succession of Oak cash and carry company. It makes investors happy and satisfied to put more investment to the business project. Crowdfunding are mainly two types such as reward based and equity based. These both sources provide funding from different methods(Pugalis And et.al., 2015).

LO3

Develop business plan that include financial information

Business plan contains planning for future which also consider the financial spreadsheets. It includes all the expenses, revenues, profits and losses. Business plan which include financial information will assist the business in financial forecasting. There are numerous stages to develop a business plan which are as follows :

- Prepare the financial statement: First step to develop a business plan is to preparing a financial statement which describe all the revenues and expenditures of the Oak cash and carry company. It also includes the profit and loss statement of the business. It is required mostly for the macro businesses(Wu, 2015). Organisations who have not numerous fixed assets than they do not need to forecast balance sheet. They just need to prepare supporting information sheet which describe all the data about the Oak cash and carry company.

- Construct a spreadsheet : It is displaying the revenue model. It considers all the variables which can be easily changed as per the calculation automatically. It is prepared monthly which forecast the revenues for each year and Oak cash and carry company will ensure that the projects are attainable.

- Marketing plan : It is necessary to do market planning for develop a business plan including financial information(Han and Lin, 2017). Under the research of market, it will provide the information regarding to cost of goods sold and other manufacturing companies. Market planning gives a reasonable estimation to determine the cost and selling price of the product.

- Conversation: Next step in developing a business plan is to convert the marketing plan into numbers. Connect all the strategies to specific costs.

- Forecasting: It is mostly associated to general and administrative expenses. Forecasting of all the expenses as direct or indirect are necessary. It considers recurring costs, professional expenses such as accounting, and other expenses which are required to run the business(Bridge and Dodds, 2018).

- Create a spreadsheet forecasting : This is the last stage in developing the business plan. It considers all the factors such as each human resource which are hired and there salary. In next year, it reckons the % increased in salary, wages, incentives or reward for performance. Total salary of all employees will show into the profit and loss statement.

Strategic objectives

Objectives consider the vision and mission of the Oak cash and carry company. Vision of the Oak cash and carry company is to build sales and profits while mission of the Oak cash and carry company is to increase customer traffic, build customer loyalty and improving department ratings. Grocery wholesaler companies have many aims and objectives(Choi, Kim and Chung, 2017). These companies always develop the marketing plans which helps the owner to get information about market and target customers. The explanation of these objectives are as follows :

- Build sales and profits : The main goal of grocery companies is to sell higher amount of products and gain higher amount of profitability margin. In addition to this, grocery companies have to face different difficulties relating to higher competition from other whole sellers. There are different strategies to increase the sales volume and overcome the negative impacts of competition. Companies are using ready to eat strategy which increase the customer potentiality(Choi, Kim and Chung, 2017). It also offers movie rentals and non food products to raise the sales and profits.

- Build customer loyalty : this is another objective of grocery companies that aim to raise the loyalty of customers in their stores. Oak cash and carry company conduct different loyalty programmes in which they give rewards to customer according to their purchase volume. Rewards may be in form of coupons or free products. It increases the customer loyalty toward their business.

- Raising customer traffic : Grocery stores always put their efforts to increase the customer traffic which is possible to locate the business in high traffic locations(Arku, Yeboah and Nyantakyi-Frimpong, 2016). Grocery companies always tries to launch their business close to apartments or residential buildings. Oak cash and carry company can increase traffic by providing parking space, easy access, proper lighting facilities who shop at night and so on.

- Improve ratings : to improve the ratings of different departments, companies conduct marketing research which analyse all the factors of each departments. Ratings can be increased if Oak cash and carry company is providing same product as customer's preferences. Consumers always expect the best quality of the products and services when they shop from groceries.

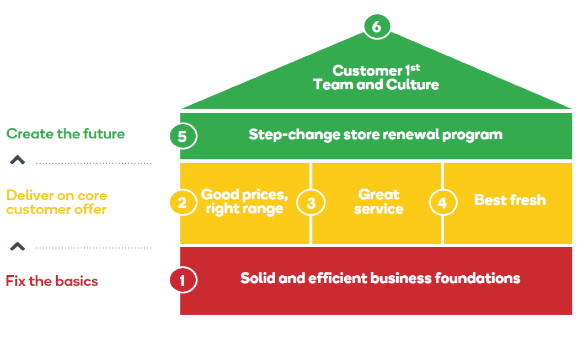

Framework to achieve objectives

Oak cash and carry company will get success if their objectives are achievable. To achieve objectives it is necessary to develop strategy which mainly focused on putting customer's first. This framework can be explained by this diagram :

To achieve aims, the Oak cash and carry company have to put following factors as priorities:

- Build store led culture

- Sustainable sales

- Provide convenience to customers

- Becoming a lean customer

The purpose to achieve objectives is to make the lives of the employees little better every day and commitment towards price(Lê And et.al., 2017). Strategy to gain objectives is to develop one team, refresh stores, update product offering, develop cohesive brand and reduce the cost of the product with improving the process.

LO4

Exit or success options for small business

There are various ways by which small business can exit the business. Owner of the small business always thinking about their next move. There are different options to exit for small business and also they have many reasons for exit. Furthermore, antithetical kinds of exit strategies for micro businesses as lifestyle entrepreneur, legacy, mergers, acquire, management buyout, liquidate or bankruptcy. The explanation of exit options are as follows :

- Liquidation :An Oak cash and carry company will go to in form of liquidation when it has to pay their creditors by selling their assets. It means they do not have enough profit amount to pay the creditors. An Oak cash and carry company will exit their business form the market when it is in liquidation. They sale their all assets and then pay the creditors as per their amount ratio (Gurran and Bramley, 2017).

- Selling to buyer :Exit the company does not always mean in negative manner. Owner of the business may sell their business to buyer or third party as they offer better amount in exchange to sale. The main objective of the small business is to make higher profitability. If buyers provide better offer in which owner get the higher margin of profitability then they sold their business.

- Acquisition : It is another form by which Oak cash and carry company can exit their business form the market. Acquisition means an Oak cash and carry company acquire the another business. It may be in form of merger(Han and Lin, 2017). Large company can acquire small business to gain more profits. There are many advantages of acquisition such as it helps in gain experience and assets, combining cultures, duplication, excite the shareholders, access to capital, knowledge and experts.

- Legacy :Many of the small businesses want to keep their business in the legacy. This is the another option to exit the business form the market.

Benefits and drawbacks of exit options :

The Oak cash and carry company can exit from the market for many reasons as discussed above. All options have different pros and cons. If Oak cash and carry company is selling their business to buyers then it may be considered as two categories like strategic buyers and financial buyers. Liquidation of an Oak cash and carry company may be in different forms such as creditors voluntary liquidation, members voluntary liquidation and compulsory liquidation.

|

Advantages |

Disadvantages |

|

|

Strategic buyers |

|

|

|

Financial buyers |

|

|

|

Acquisition |

|

|

|

Legacy |

|

|

|

Liquidation |

|

|

Recommendations

There are various reasons to exit the business form the market such as lack of profits, loss of interest, future prospects, dissolved partnership, not able to take further risks, personal reasons or unfavourable economic conditions. It is recommended to the company that always keep the balance sheet and review the activities of the business. If company is not getting profitability margin than employees will not motivate to continue their work. If owner of the company feels that start something new will give better remunerative than it is recommended to sell the business to financial buyers (Plotnikov And et.al., 2015). Company has to be ensure about the short term and long term prospects. Many of the companies doing well in short term but not capable to run their business in long term. So it is essential to review all the factors and situations related to future prospects. If company will know the situations and demands of long term sustainability then it is easy to operate the business. Sometimes, companies start the business on the basis of partnership. But if one partner opts out from the partnership then it is difficult to run the business. So it is also recommended to the business that merge their business to another company which will provide support to accomplish the activities (Floyd, 2015).

CONCLUSION

From the above report it can be concluded that all the companies have to develop the plan for the growth of their business. There are various options to grow the business which consider the factors like Competitive Advantage, Resources and Capabilities. It will be identify by the Ansoff's growth matrix. Furthermore, there are various sources of funds by which Oak cash and carry company can fulfil their requirement of investment. Types of funds includes Personal savings, Family and friends, Cloud funding, Angel investors, Venture capital and Bank loans. These all sources have different advantages and drawbacks. In addition to this, from the above report it is resulted that developing a business plan is very important for the business. This plan describes the financial information which are essential for forecasting. This report also described the strategic objectives of the Oak cash and carry company which explain the vision and mission. This report also defined the ways by which a small business can exit their operation from the market. There may be various reasons of a business to exit. It also includes the valid recommendations to support the implementation.

Visit the blog section of our website to enjoy more informative blogs written by thesis help professionals.

REFERENCES

Books and Journals

- Armstrong, G. and et.al., 2015. Marketing: an introduction. Pearson Education.

- Choi, M., Kim, S. H. and Chung, H., 2017. Optimal shipyard facility layout planning based on a genetic algorithm and stochastic growth algorithm. Ships and Offshore Structures. 12(4). pp.486-494.

- Deng, Y., Ma, R. and Zhang, H. M., 2017. An optimization-based highway network planning procedure with link growth probabilities. Transportmetrica A: Transport Science, pp.1-19.

- Floyd, D., 2015. Planning for growth. Management Services.

- Gurran, N. and Bramley, G., 2017. Conclusion: Reuniting Planning and Housing Policy. In Urban Planning and the Housing Market (pp. 363-385). Palgrave Macmillan UK.

- Han, H. and Lin, L., 2017. Predicting Growth of City's Built-up Land Based on Scenario Planning. International Review for Spatial Planning and Sustainable Development, 5(2), pp.80-92.

- Wu, F., 2015. Planning for growth: Urban and regional planning in China. Routledge.

- Pugalis, L. And et.al., 2015. Planning for Growth: The Role of Local Enterprise Partnerships in England Final report. RTPI Research Reportno, 9.

- Wynn, M. ed., 2017. Routledge Revivals: Planning and Urban Growth in Southern Europe (1984). Taylor & Francis.

- Bridge, J. and Dodds, J. C., 2018. Planning and the Growth of the Firm. Routledge.

- Lê, M. And et.al., 2017. Personalized radiotherapy planning based on a computational tumor growth model. IEEE transactions on medical imaging. 36(3). pp.815-825.

- Boddy, M. and Hickman, H., 2014. Planning for growth: Planning reform and the Cambridge Phenomenon.

- Pothukuchi, K., 2015. Five decades of community food planning in Detroit: City and grassroots, growth and equity. Journal of Planning Education and Research. 35(4). pp.419-434.

- Arku, G., Yeboah, I. E. and Nyantakyi-Frimpong, H., 2016. Public parks as an element of urban planning: a missing piece in Accra's growth and development. Local Environment. 21(12). pp.1500-1515.

- Plotnikov, V. And et.al., 2015. Harmonization of Strategic Planning Indicators of Territories’ Socioeconomic Growth. Regional and Sectoral Economic Studies. 15(2). pp.105-114.